In a dramatic shift, the US Department of Transportation (DOT) announced on April 17, 2025, that the federal government will assume control of the long-stalled Penn Station renovation from New York’s Metropolitan Transportation Authority (MTA), handing the project to Amtrak. The move, which Secretary Sean Duffy claims will “save taxpayers approximately $120 million,” reflects both deep frustration with local mismanagement and a broader push for a public-private partnership (PPP) model—but leaves many questions about execution, funding, and the future of America’s busiest transit hub.

Penn Station’s Age‑Old Woes

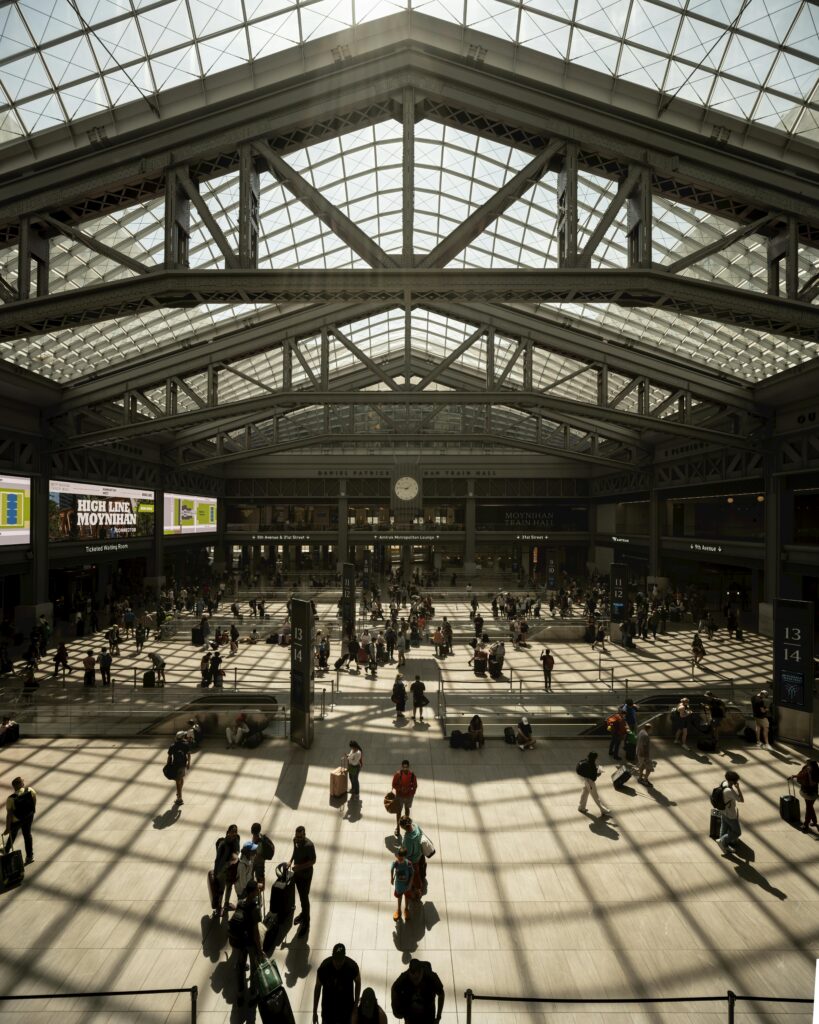

Serving over 600,000 daily commuters, Penn Station is the busiest transit node in the Western Hemisphere and a critical nexus for Amtrak, the MTA’s Long Island Rail Road (LIRR), and NJ Transit. Plagued by cramped platforms, outdated facilities, and poor passenger flow, the station has lagged behind global peers like London’s King’s Cross or Tokyo Station. Previous MTA-led plans—such as the $1.6 billion East End Gateway concourse and the conversion of the cavernous James A. Farley Post Office into Moynihan Train Hall—have advanced slowly, mired in stakeholder conflicts (notably with Madison Square Garden above the station) and funding disputes.

Why the Federal Intervention?

1. Alleged MTA Inefficiency: Duffy’s statement lambasted the MTA for “inefficiency, waste and mismanagement,” arguing a federal hand can streamline decision‑making and procurement.

2. Taxpayer Savings Claim: The DOT asserts that by leveraging private capital and expertise under a PPP framework, the project could trim an estimated $120 million off the taxpayer burden—though details on cost‑saving mechanisms remain undisclosed.

3. Amtrak’s Expanded Role: As a federally funded entity, Amtrak will now coordinate design, construction, and budgeting, with the DOT promising that “every dollar is spent wisely” to create a station “reflecting America’s greatness.”

Public‑Private Partnerships: Hopes and Risks

Under the proposed PPP model, private investors would fund portions of the construction—potentially accelerating delivery and introducing innovative technologies in exchange for future revenue shares (e.g., retail leases or naming rights).

- Global Examples: Cities like London (Crossrail) and Toronto (Union Station Revitalization) have successfully used PPPs to modernize rail hubs.

- Potential Pitfalls: Critics warn of long-term lease obligations, profit motives overshadowing public interest, and reduced governmental oversight.

Stakeholder Reactions

- MTA and Local Officials: New York Governor Kathy Hochul and MTA Chair Janno Lieber have expressed concern over federal overreach and the disruption of an MTA–Madison Square Garden legal compromise that protects arena operations above the station.

- Unions and Workers: Labor groups worry job protections and prevailing‑wage requirements may be weakened under private contracts.

- Riders and Advocacy Groups: Commuters lament opaque cost‑saving claims and demand clarity on fare impacts, construction timelines, and maintenance of service levels during the overhaul.

Amtrak Leadership Shake‑Up

Barely a month before the takeover, Amtrak’s CEO Stephen Gardner resigned “to ensure … full faith and confidence of this administration,” following Elon Musk’s public critique that Amtrak is “a sad situation” and should be privatized. The abrupt leadership change adds uncertainty to the transition, as incoming executives must align federal goals with Amtrak’s operational realities.

Funding and Timeline

- Infrastructure Law Dollars: A significant portion of the $66 billion federal rail grant program (under the Infrastructure Investment and Jobs Act) may be tapped for Penn Station upgrades.

- Projected Phases: Early‑stage work could include stabilizing existing structures and fast‑tracking platform expansions. Full completion of a modernized concourse, new entrances, and accessibility upgrades might extend into the early 2030s unless private investment accelerates delivery.

What Comes Next?

- Detailed PPP Agreements: The DOT and Amtrak must publish the terms of private partnerships, including risk‑sharing, revenue models, and oversight mechanisms.

- Community and Stakeholder Engagement: Transparent town halls and advisory councils will be critical to address displacement concerns (e.g., local business impacts) and labor protections.

- Monitoring and Accountability: Real‑time progress dashboards—similar to those used for federal highway projects—could help rebuild public trust and track expenditure against milestones.

Frequently Asked Questions

Q: Why is the federal government seizing control from the MTA?

A: Citing years of delays, cost overruns, and stakeholder gridlock, the DOT believes a direct federal–Amtrak partnership can deliver faster, more cost‑effective results.

Q: What does a public-private partnership entail?

A: Private investors fund construction in exchange for returns via station revenue streams; the government retains regulatory oversight and ensures public interests are protected.

Q: How will this save $120 million?

A: The DOT claims efficiencies from private capital deployment and streamlined procurement will cut costs, though specifics on savings mechanisms are pending disclosure.

Q: Will fares increase to cover the project?

A: There are no immediate fare hikes planned, but long-term financing structures and revenue-sharing agreements could influence future fare policies.

Q: How will NJ Transit and LIRR services be affected?

A: Amtrak’s management must coordinate with both agencies to maintain current service during construction and integrate future capacity improvements.

Q: What about Madison Square Garden?

A: Current legal agreements protecting MSG’s lease above Penn Station are said to remain intact, but any changes could prompt new negotiations.

Q: Who is the new Amtrak leadership?

A: An interim CEO will lead until a permanent appointee—expected to have strong PPP and infrastructure finance experience—is confirmed by the DOT.

Q: How can the public track progress?

A: The DOT has proposed online dashboards and regular public updates, though implementation details are forthcoming.

Q: What lessons from other global stations apply here?

A: Incorporating mixed‑use developments (e.g., retail, offices) and seamless transit connections—seen at London’s St Pancras and Tokyo Station—could guide Penn’s rebuild.

Q: When will the new Penn Station open?

A: Initial stabilization work begins in 2025; full operational completion may extend into the early 2030s, depending on PPP investment and construction pace.

Sources The Guardian